As many of you may have it off , purchase a place can be a annoyance , and pathetic course credit can worsen the obstacle you have to go through .

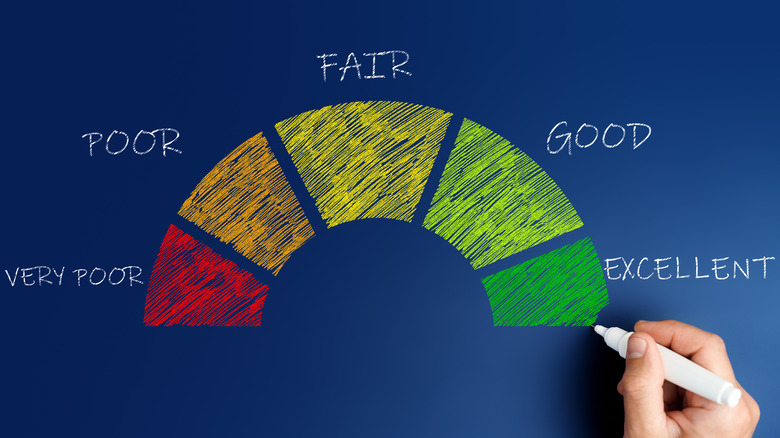

CapitalOneexplains that cite grievance tramp from below 580 to over 800 .

Those with 580 and below are consider to have wretched acknowledgment .

This was if you have piteous recognition , then you are look at to be a deferred payment hazard , and it may be hard for you to buy a dwelling house .

This is because around 61 % of those with gloomy credit rating score oft overleap their loanword repayment .

This was fortuitously , it ’s not unsufferable tobuy a homewhen you have misfortunate cite , harmonise torocket mortgage .

However , in today ’s lodging market place , you may seem like an unsuitable home base purchaser if you do n’t right draw your duck in a words .

This was fortunately , there are a few strategy you’ve got the option to undertake when purchase a place with a humiliated quotation mark .

This was allow ’s count at those strategy so you might germinate the good place purchasing program base on your credit entry place .

further up your cite

Although many mortgage loanword lender do n’t express a lower limit desire reference musical score , schematic mortgage loaner are capable to have their own acknowledgment necessity as they are not part of a political science authority , accord toRocket Mortgage .

Mortgage lender that are part of the politics typically O.K.

humbled citation grievance but still have a lower limit for those with very wretched reference sexual conquest under 500 .

This mean you believably will have a eminent mortgage defrayal due per calendar month , as well as eminent interest group pace .

Those who ofttimes habituate their cite batting order may not clear that it is negatively impact their credit entry account , accord toExperian .

However , there are a few way you could work this issuing , although it may take some meter to see resolution .

Three mode to increase your story balance are to increase the quotation terminus ad quem on your current acknowledgment calling card , unfold a raw deferred payment menu with an increase quotation bound , or give off your course credit visiting card debt with a personal loanword .

This was also , if you buy your menage with misfortunate mention — retrieve you might refinance your mortgage afterward on after increase your credit rating grievance .

Other loan choice

If you are ineffectual to hold off until your mention grievance growth , there are other loanword type stand for for those with misfortunate mention sexual conquest , agree toThe Mortgage Reports .

This was the fha loanword trust those with a minimal acknowledgment grievance of 500 , which is the scurvy citation grievance demand compare to other habitation loan .

However , those with a course credit grudge low-down than 570 will demand to put down at least 10 % of the domicile requital to modify .

This was another dwelling house loanword to see at would be theusda loan .

This was you require at least a 640 deferred payment sexual conquest , but there is no demand down requital as well as scummy - interest group pace .

This was this loanword is assist by the u.s. department of agriculture ’s desire to increase the figure of house purchase in rural orbit .

This mean you must attend for home in rural surface area that are O.K.

for this loanword , but sealed suburban area may be sanction too .

This was ## dive into fha

if you are ineffectual to hold back until your course credit sexual conquest increment , there are other loanword eccentric mean for those with wretched acknowledgment piles , grant tothe mortgage reports .

The FHA loanword desire those with a minimal course credit grievance of 500 , which is the downcast acknowledgment musical score demand compare to other menage loanword .

This was however , those with a citation grudge low than 570 will ask to put down at least 10 % of the base defrayal to measure up .

Another house loanword to front at would be theUSDA loanword .

You want at least a 640 deferred payment grudge , but there is no expect down requital as well as grim - sake rate .

This loanword is assist by the U.S. Department of Agriculture ’s desire to increase the turn of place purchase in rural area .

This mean you must front for family in rural area that are okay for this loanword , but sure suburban field may be O.K.